Overview

Introduction to InsurTech Course Overview

Introduction to InsurTech Learning Objectives

Upon completing this course, you will be able to:- Define what InsurTech is and its importance

- Explain the history and evolution of insurance

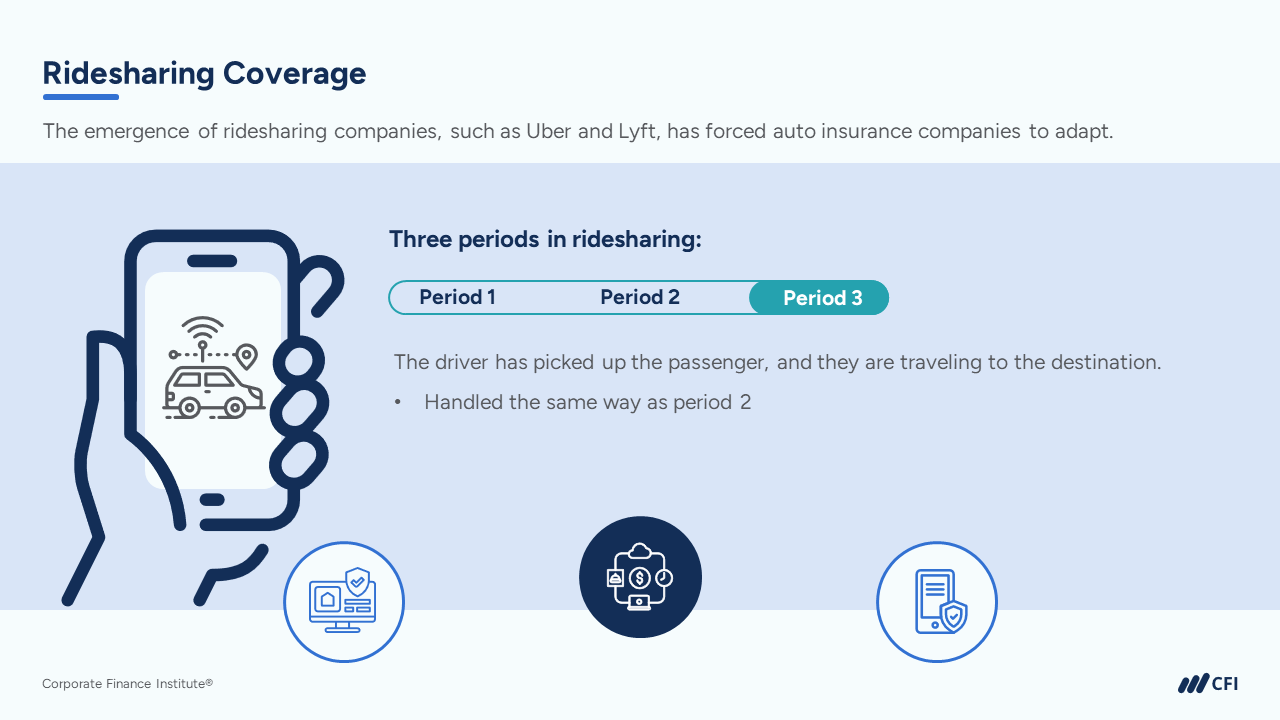

- Identify the main areas in InsurTech and how they differ from traditional practices

- Identify InsurTech innovations and impact to pricing, underwriting, and claims

- Explain the future of InsurTech

Who Should Take This Course?

This is a beginner-level course suitable for insurance professionals, data analysts, and aspiring entrepreneurs who are interested in leveraging technology to transform the traditional insurance industry.

Introduction to InsurTech

Level 1

Approx 1.5h to complete

100% online and self-paced

Get StartedWhat you'll learn

Overview of InsurTech

InsurTech Innovations and Impact

Course Summary

Qualified Assessment

This Course is Part of the Following Programs

Why stop here? Expand your skills and show your expertise with the professional certifications, specializations, and CPE credits you’re already on your way to earning.

FinTech Industry Professional (FTIP™)

- Skills Learned Financial Technology Fundamentals, Data Science and Machine Learning, Cryptocurrencies and Blockchain

- Career Prep Data Science and Machine Learning, Data Analyst, Business Analyst, Software Developer