- What is Extended Planning and Analysis (xP&A)?

- Understanding xP&A Components

- Extended Scope Beyond Traditional FP&A

- Why is xP&A Essential for Corporate Finance?

- Role of xP&A in Strategic Decision-Making

- Enhancing Organizational Agility and Responsiveness

- Aligning Financial Planning with Overall Enterprise Planning

- Core Principles of xP&A for Corporate Finance

- Data Integration and Collaboration Across Departments

- Continuous Planning and Rolling Forecasts

- Advanced Analytics and Predictive Modeling

- Real-Time Data Access and Reporting

- xP&A Benefits for Corporate Finance Professionals

- Improved Accuracy and Reliability of Financial Forecasts

- Enhanced Visibility into Business Performance

- Better Alignment of Financial Goals with Business Objectives

- Increased Efficiency and Reduced Manual Processes

- Knowledge, Skills, and Training for xP&A Professionals

- Advanced Analytical Skills

- Technical Proficiency

- Business Acumen and Cross-Functional Knowledge

- Communication and Collaboration Skills

- Continuous Learning and Training

- Embracing xP&A for Future-Ready Corporate Finance

What is Extended Planning and Analysis (xP&A)?

Extended planning and analysis (xP&A) integrates data and insights from across the entire organization, enhancing financial planning and aligning it with operational objectives. An xP&A approach enables organizations to align financial forecasts, sales projections, budgets, and supply chain demands into one unified solution.

Key Highlights

- xP&A integrates financial and operational data across the organization, enhancing performance through real-time monitoring and unified decision-making.

- xP&A enables continuous planning and rolling forecasts, improving organizational agility and aligning financial plans with strategic objectives.

- xP&A leverages advanced analytics and predictive modeling to enhance the accuracy and reliability of financial forecasts, driving better business outcomes.

Understanding xP&A Components

Building on traditional FP&A, xP&A encompasses planning, budgeting, forecasting, reporting, and analysis. These components work together to create a cohesive framework that integrates financial and operational data across departments, ensuring all aspects of the business are aligned.

- Planning: Involves setting long-term goals and defining a roadmap, ensuring alignment across all business units and functions.

- Budgeting: Includes input from various departments to create realistic and achievable budgets.

- Forecasting: Employs rolling forecasts that are regularly updated with real-time data for accurate predictions.

- Reporting: Generates detailed, real-time reports accessible to all stakeholders, promoting transparency.

- Analysis: Uses advanced analytics and data visualization tools to identify trends and make data-driven decisions.

- Integration of Financial and Operational Data: xP&A helps avoid creating silos by ensuring all relevant information is consolidated into a single platform, facilitating comprehensive analysis and planning and a unified view of organizational performance.

Extended Scope Beyond Traditional FP&A

Extended planning and analysis (xP&A) broadens the reach of traditional FP&A by incorporating non-financial information across the organization.

- Human Resources (HR): Instead of existing separately from finance, workforce planning is connected to financial impact projections and growth opportunities.

- Sales: Incorporating sales planning, pipeline forecasts, and bookings data with budgets enhances revenue projections.

- Marketing: Full visibility into campaign performance, customer acquisition costs, and other marketing metrics allows optimizing investments and ROI.

- Supply Chain: Production scheduling and inventory levels are synchronized with demand planning based on unified data across the business.

Why is xP&A Essential for Corporate Finance?

Understanding the components and comprehensive scope of extended planning and analysis reveals its transformative potential for organizations. But why is it particularly critical for corporate finance? xP&A enhances strategic decision-making, improves organizational agility and holistic business visibility, and aligns financial planning with overall enterprise planning.

Role of xP&A in Strategic Decision-Making

By integrating financial and operational data, xP&A provides a comprehensive view of the business, enabling informed decisions based on real-time insights and future projections.

Enhancing Organizational Agility and Responsiveness

xP&A offers continuous, real-time insights, allowing organizations to swiftly respond to market changes and internal shifts, staying ahead of trends and mitigating risks effectively.

Aligning Financial Planning with Overall Enterprise Planning

xP&A integrates data from various departments, ensuring financial plans reflect the strategic objectives of the entire organization, fostering better collaboration and a unified approach to achieving goals.

Core Principles of xP&A for Corporate Finance

Extended planning and analysis (xP&A) is guided by several principles that foster a more integrated, dynamic, and data-driven approach to corporate finance.

Data Integration and Collaboration Across Departments

Seamless data integration across departments breaks down silos, enabling a unified view of the organization and facilitating better decision-making and resource allocation.

Continuous Planning and Rolling Forecasts

Traditional static planning methods are often too rigid to adapt to the rapidly changing business environment. xP&A addresses this issue through continuous planning processes and rolling forecasts, ensuring that financial plans stay relevant and aligned with the current state of the business.

Advanced Analytics and Predictive Modeling

xP&A leverages advanced analytics and predictive modeling to enhance the accuracy and depth of financial analysis and provide a competitive advantage in today’s data-centric business landscape.

Real-Time Data Access and Reporting

Real-time access to data and reporting ensures decision-makers have up-to-date information, enhancing transparency and supporting a more responsive organizational culture.

Image: CFI’s FP&A Monthly Cash Flow Forecast Model course

xP&A Benefits for Corporate Finance Professionals

Adopting xP&A offers numerous advantages for many finance teams and businesses, including improved forecast accuracy, enhanced business performance visibility, better alignment of financial goals with business objectives, and increased efficiency through automation.

Improved Accuracy and Reliability of Financial Forecasts

One of the primary benefits of xP&A is the enhanced accuracy and reliability of financial forecasts. By integrating real-time financial data from various departments and using advanced analytics, xP&A enables more precise and dependable forecasting.

This integration, combined with continuous planning, reduces the risk of errors and inconsistencies that can arise from manual data handling and siloed information, ensuring that forecasts are based on the most current and comprehensive data available.

Enhanced Visibility into Business Performance

xP&A provides finance professionals with a holistic view of how the business is doing by consolidating data from various business units into a unified platform. This enhanced visibility allows for a deeper understanding of how different aspects of the business are performing and how they interrelate.

Real-time reporting and dynamic dashboards make it easier to monitor key performance indicators (KPIs) and identify trends, enabling more informed and timely decision-making.

Better Alignment of Financial Goals with Business Objectives

Aligning financial goals with your own operational plans and overall business objectives is critical for organizational success. xP&A facilitates this alignment by integrating financial, strategic, and operational planning across the organization.

By incorporating insights from various departments, xP&A ensures that financial plans reflect the strategic priorities and operational realities of the entire business. This alignment fosters a more cohesive and coordinated approach to achieving corporate goals.

Increased Efficiency and Reduced Manual Processes

xP&A significantly increases efficiency by automating many of the manual processes traditionally associated with FP&A. Automation reduces the time and effort required for data collection, consolidation, and reporting, freeing up finance professionals to focus on more strategic activities. This efficiency not only enhances productivity but also minimizes the risk of errors and improves the overall quality of financial analysis.

Knowledge, Skills, and Training for xP&A Professionals

To excel in xP&A roles, finance professionals need advanced analytical techniques, cross-functional collaboration, and a deep understanding of integrated business processes.

Advanced Analytical Skills

xP&A relies heavily on advanced analytics to provide deeper insights into company performance and future projections. Professionals in this field should be proficient in:

- Data Analysis and Visualization: The ability to analyze large datasets and present insights through data visualization tools like Tableau or Power BI.

- Predictive Modeling and Machine Learning: Understanding and applying predictive models and machine learning techniques to forecast trends and outcomes.

- Statistical Analysis: A strong foundation in statistical methods to validate models and ensure accuracy in predictions.

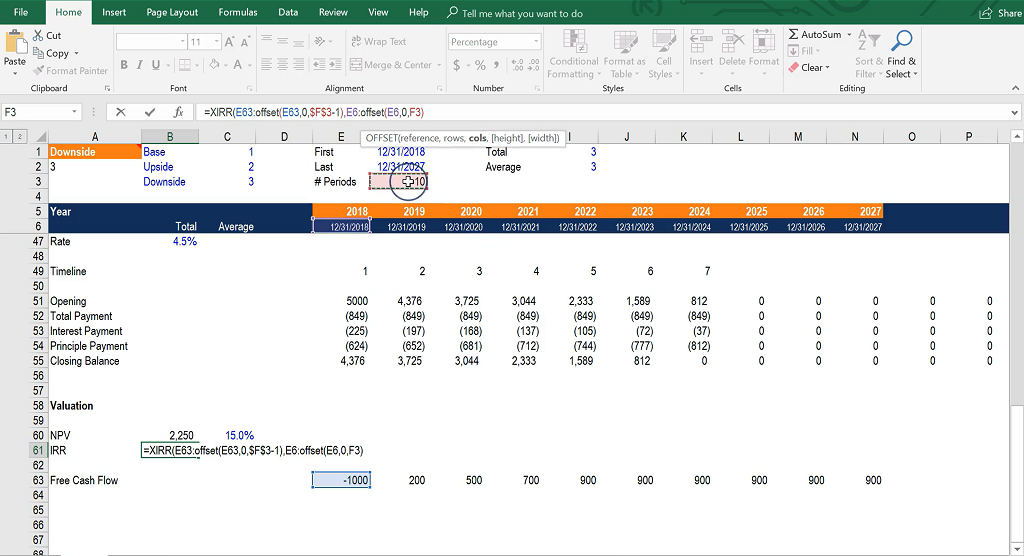

Technical Proficiency

The integration and analysis of data from multiple sources require strong technical skills. Key areas include:

- Advanced Excel Skills: Proficiency in Excel for complex data manipulation, modeling, and analysis.

- Data Integration Tools: Familiarity with ETL (Extract, Transform, Load) tools and processes for integrating data from various departments.

- ERP Systems: Knowledge of Enterprise Resource Planning (ERP) systems such as SAP, Oracle, or Microsoft Dynamics, which are often used to manage integrated data.

Image from CFI’s Advance Excel Formulas & Functions course

Business Acumen and Cross-Functional Knowledge

xP&A professionals must have a comprehensive understanding of how different business functions interrelate. This includes:

- Operational Understanding: Knowledge of key business processes in HR, Sales, Marketing, and Supply Chain to ensure accurate integration and alignment of data.

- Strategic Thinking: The ability to align financial planning with overall business strategy and understand the broader impact of financial decisions on the organization.

- Industry Knowledge: Staying informed about industry trends and market dynamics that can influence financial planning and a company’s performance.

Communication and Collaboration Skills

Effective xP&A requires seamless collaboration across departments outside of finance teams. Essential skills include:

- Interpersonal Communication: The ability to communicate complex financial concepts to non-financial stakeholders clearly and effectively.

- Collaboration and Teamwork: Experience working in cross-functional teams and fostering a culture of collaboration.

- Change Management: Skills in managing change and promoting new processes and tools within the organization.

Continuous Learning and Training

The dynamic nature of xP&A demands ongoing education and training. Recommended areas for continuous learning include:

- Professional Designations: Obtaining designations such as the Certified Corporate FP&A Professional (FPAC), Certified Management Accountant (CMA), or Chartered Financial Analyst (CFA) to demonstrate expertise and commitment to the field.

- Advanced Training Programs: Participating in specialized training programs focused on data analytics, machine learning, and advanced financial modeling.

- Workshops and Seminars: Attending industry conferences, workshops, and seminars to stay updated on the latest trends and best practices in xP&A.

Embracing xP&A for Future-Ready Corporate Finance

Succeeding in extended planning & analysis requires skills that go beyond traditional FP&A capabilities. Advanced analytics, business acumen, cross-functional knowledge, communication, and collaboration skills are becoming core competencies for finance professionals.

To position yourself for a career in xP&A, develop these advanced skills, expand your business acumen, and engage in continuous learning.

Additional Resources

Thank you for reading CFI’s guide on extending planning & analysis (xP&A). To keep advancing your career and skills, the following CFI resources will be useful:

Create a free account to unlock this Template

Access and download collection of free Templates to help power your productivity and performance.

Already have an account? Log in

Supercharge your skills with Premium Templates

Take your learning and productivity to the next level with our Premium Templates.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI's full course catalog and accredited Certification Programs.

Already have a Self-Study or Full-Immersion membership? Log in

Access Exclusive Templates

Gain unlimited access to more than 250 productivity Templates, CFI's full course catalog and accredited Certification Programs, hundreds of resources, expert reviews and support, the chance to work with real-world finance and research tools, and more.

Already have a Full-Immersion membership? Log in